After a long run of success, the world’s largest fast-food chain is floundering—and activist investors are circling

The company is planning to roll out its “Create Your Taste” burgers in up to 2,000 restaurants—it is not saying where—by late 2015, and possibly in more places if they do well. McDonald’s is also trying to engage with customers on social media and is working on a smartphone app, as well as testing mobile-payment systems such as Apple Pay, Softcard and Google

After a successful run which lifted the firm’s share price from $12 in 2003 to more than $100 at the end of 2011, McDonald’s had a tricky 2013 and a much harder time last year. When it announces its annual results on January 23rd, some analysts fear it will reveal a drop in global “like-for-like” sales (ie, after stripping out the effect of opening new outlets) for the whole of 2014—the first such fall since 2002.

In the past year Don Thompson, the firm’s relatively new boss, has had to fight fires around the world, some of them beyond his control. Sales in China fell sharply after a local meat supplier was found guilty of using expired and contaminated chicken and beef. Some Russian outlets were temporarily closed by food inspectors, apparently in retaliation for Western sanctions against Russia over its military intervention in Ukraine. And a strike at some American ports left Japanese McDonald’s outlets short of American-grown potatoes, forcing them to ration their portions of fries. (More recently several Japanese customers have reported finding bits of plastic, and even a tooth, in their food.)

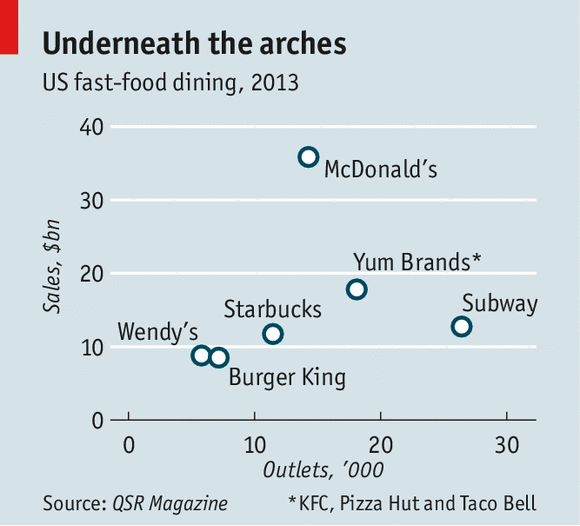

However, the biggest problem has been in America—by far McDonald’s largest market, where it has 14,200 of its 35,000 mostly franchised restaurants. In November its American like-for-like sales were down 4.6% on a year earlier. It had weathered the 2008-09 recession and its aftermath by attracting cash-strapped consumers looking for a cheap bite. But more recently it has been squeezed by competition from Burger King, revitalised under the management of a private-equity firm, from other fast-food joints such as Subway and Starbucks, and from the growing popularity of slightly more upmarket “fast casual” outlets (see article).

In response, McDonald’s has expanded its menu with all manner of wraps, salads and so on. Its American menu now has almost 200 items. This strains kitchen staff and annoys franchisees, who often have to buy new equipment. It may also deter customers. “McDonald’s stands for value, consistency and convenience,” says Darren Tristano at Technomic, a restaurant-industry consultant, and it needs to stay true to this. Most diners want a Big Mac or a Quarter Pounder at a good price, served quickly. And, as company executives now acknowledge, its strategy of reeling in diners with a “Dollar Menu” then trying to tempt them with pricier dishes is not working.

McDonald’s says it has got the message and is experimenting in some parts of America with a simpler menu: one type of Quarter Pounder with cheese rather than four; one Snack Wrap rather than three; and so on. However, this seems to run contrary to the build-your-burger strategy it is trying elsewhere, which expands the number of choices. That in turn is McDonald’s response to the popularity of “better burger” chains, such as Shake Shack, which has just filed for a stockmarket flotation.

Some analysts think that McDonald’s should stop trying to replicate all its rivals’ offerings and go back to basics, offering a limited range of dishes at low prices, served freshly and quickly. Sara Senatore of Sanford C. Bernstein, a research outfit, notes that Burger King, having struggled against its big rival for years, has begun to do better with a simpler and cheaper version of the McDonald’s menu. For the third quarter of 2014 Burger King reported a like-for-like sales increase of 3.6% in America and Canada compared with a decrease by 3.3% of comparable sales at McDonald’s. That said, sales at an average McDonald’s in America are still roughly double those of an average Burger King. So the case for going back to basics remains unproven.

So far, McDonald’s looks as if it is undergoing a milder version of its last crisis, in 2002-03. Then, an over-rapid expansion had damaged its reputation for good service, its menu had become bloated and customers were drifting to rivals claiming to offer healthier food. Now, once again, “McDonald’s has a huge image problem in America,” says John Gordon, a restaurant expert at the Pacific Management Consulting Group. This is in part because of its use of frozen “factory food” packed with preservatives. In 2013 a story about a 14-year-old McDonald’s burger that had not rotted received huge coverage. Even Mike Andres, the new boss of the company’s American operations, recently asked bemused investors: “Why do we need to have preservatives in our food?” and then answered himself: “We probably don’t.”

McDonald’s doesn’t seem to be cool any more, especially among youngsters. Parents say their teenage children have been put off after seeing “Super Size Me”, a documentary about surviving only on McDonald’s food; and “Food, Inc”, another about the corporatisation of the food industry; and by reading “Fast Food Nation: The Dark Side of the All-American Meal”. It is hard to imagine the new McDonald’s initiatives getting the reaction Shake Shack got when it opened its first outlet in downtown Chicago in November: for the first two weeks it had long queues of people waiting outside in the freezing cold.

A lot of the negative PR that McDonald’s gets is the flipside of being the world’s biggest and most famous fast-food chain. This has made it the whipping-boy of food activists, labour activists, animal-rights campaigners and those who simply dislike all things American. In America it has been the focus of a campaign for fast-food workers and others to get a minimum salary of $15 an hour and the right to unionise. Last month the National Labour Relations Board, a federal agency, released details of 13 complaints against McDonald’s and many of its franchisees for violating employees’ rights to campaign for better pay and working conditions. The alleged violations relate to threats, surveillance, discrimination, reduced hours and even sackings of workers who supported the protests. McDonald’s contests these charges, while arguing that it is not responsible for its franchisees’ labour practices.

Not all the criticism McDonald’s gets may be merited—or at least it should be shared more fairly with its peers. However, the company’s troubles have begun to attract the attention of activist shareholders, who may prove somewhat harder to brush aside than labour or food activists. In November Jana Partners, an activist fund, took a stake in the firm. Then in December its shares jumped, on rumours that one of the most prominent and determined activists, Bill Ackman, intended to buy a stake and press for a shake-up.

McDonald’s says it welcomes all investors and is focused on maximising value for its shareholders. Even so, Mr Thompson’s new strategy needs to deliver results quickly. Mr Ackman’s Pershing Square Capital has done well out of its 11% stake in Burger King, because the chain’s main shareholder, 3G Capital, has pushed through a drastic cost-cutting programme and a merger with Tim Hortons, a Canadian restaurant group. “If McDonald’s were run like Burger King, the stock would go up a lot,” Mr Ackman mused recently. It looks like Mr Thompson may soon have to fight on another front.